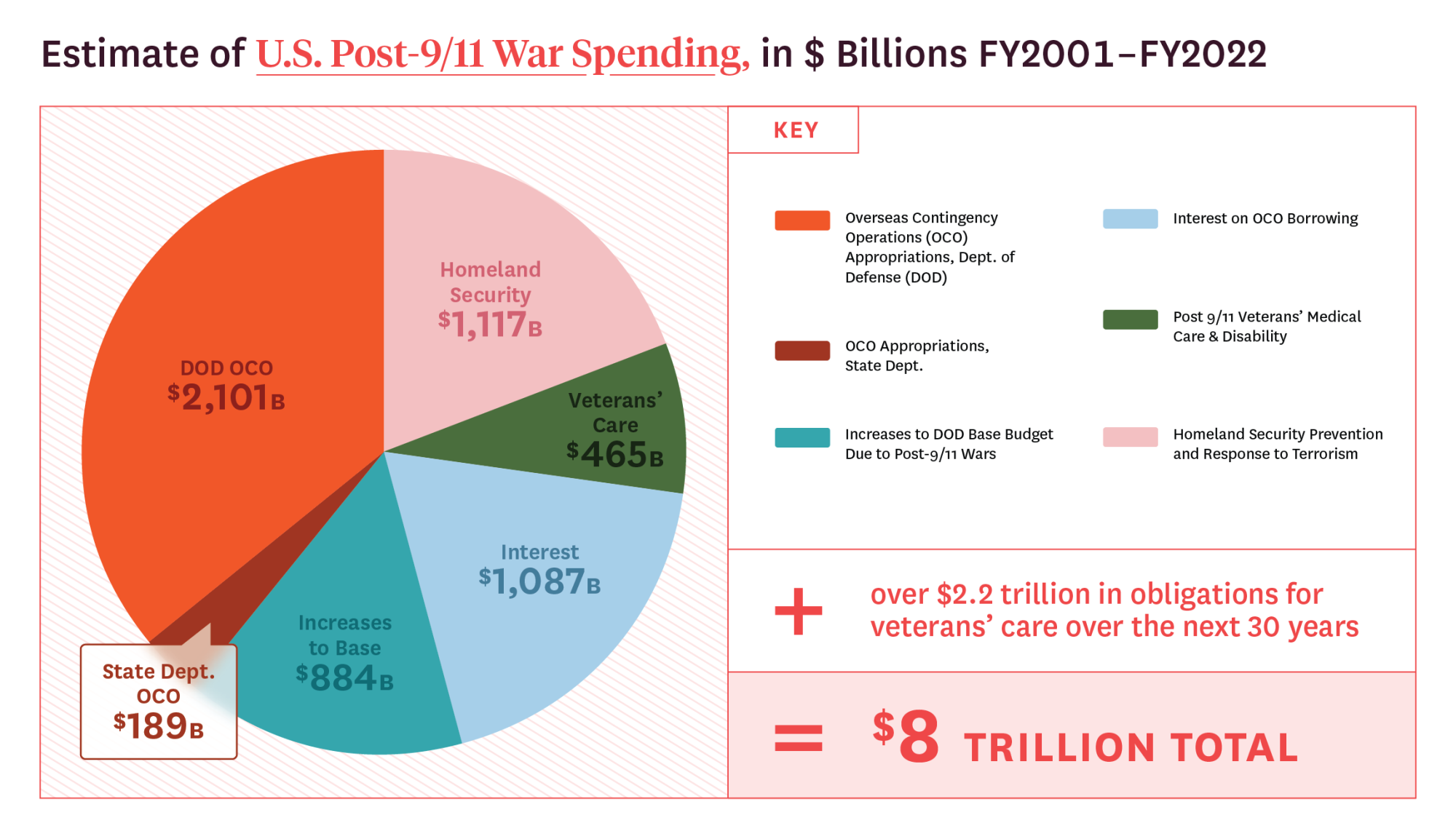

The economic costs of military interventions take many forms, including the increased costs to the federal budget – including not only the costs borne by the Department of Defense, but also increased costs for veterans’ benefits. In the case of the post-9/11 wars, including and beyond the U.S.-led wars in Afghanistan and Iraq, war costs also include spending on Department of Homeland Security efforts within the U.S. to prevent and counter terrorism. Future spending is obligated for veterans’ care, and there are increased interest payments on war borrowing. For this reason, even after the withdrawal of U.S. troops from Afghanistan in 2021, budgetary costs continue to increase.

U.S. post-9/11 war costs also includes local and state public spending – untallied by Costs of War – and spending on U.S. foreign assistance for reconstruction in post-9/11 war zones.

The post-9/11 wars were funded largely through debt, rather than through increased taxes or the sale of war bonds, as U.S. wars of the past were funded. The use of debt rather than increased taxes makes war more invisible to taxpayers, obscuring the true costs of war by pushing financial obligations to future generations. Moreover, increased public debt results in higher interest rates economy-wide, which can hamper business investments and make life more expensive for individuals and families.

Since the U.S. withdrawal from Afghanistan in 2021, the Pentagon as well as advocates for increased U.S. military spending focus on China and Russia as the new national security challenge, terming this “great power competition.” U.S. discourses about security threats from China and Russia are characterized by threat inflation. The U.S. outspends all other countries in the world on military expenditures.